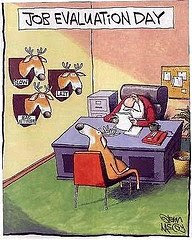

I had my annual evaluation for 2008 yesterday. My company does performance evaluations twice a year; once around June or July and then again at the end of January. Raises are only given once a year during the January evaluation.

I went into my evaluation with an open mind and low expectations. Due to the struggling economy, there are a lot of companies that are not giving raises this year and/or trimming the payroll. Some companies are even reducing salaries or cutting the number of hours. I feel that my job is pretty secure but and I didn't think there would be any issues with my performance.

At first, it was hard to not expect any money since I received a very good raise and merit cash equal to 5% of my yearly salary in 2007. In 2008, I didn't receive the merit cash but I still received a nice raise and a $500 bonus.

After reviewing my performance with my manager, I came out of my review with a 2% raise. I was very happy to get any kind of raise; especially since a couple of my co-workers didn't get a raise at all.

What do I plan to do with my raise? It's going into the savings account of course. I've made a conscious effort for the past few years to make sure that my expenses did not increase just because my income increased.

Reminder: Please be sure to subscribe to SingleGuyMoney for more personal finance posts.

Subscribe to:

Post Comments (Atom)

Congrats on the raise! Take care!

Very nice my friend! I haven't gotten a raise in over a year, but keeping my mouth shut as i get paid a little too much anyways ;)

I'm hoping the next couple months start turning around though and we'll get what's overdue - but for now i'm just happy w/ the job!

Congratulations on your raise. What a nice surprise. This raise moves you one step closer to being debt free!!!!!

Congrats! I also got a raise ... 3.25%! I was very happy, considering this economy and since I'm in banking. But my job is secure and I'm not worried.

"What do I plan to do with my raise? It's going into the savings account of course. I've made a conscious effort for the past few years to make sure that my expenses did not increase just because my income increased."

Awesome- you are one of the very slim majority who actually recognizes and defeats Parkinson's Law of Finance, which states that expenses rise at the same rate as income does (sometimes even faster with cheap credit). That's the financial downfall of so many.

Wow! Congratulations! We just got a 12% cut in pay (in the form of furloughs) and news that the legislature has cut our budget so severely that we can expect another 1,000 layoffs (for starters).

Does your company have any openings for editors or janitors? ;-)

@Funny about Money: Nope, we are on a hiring freeze just like everyone else.

Making sure your pay-rise goes into your savings is an excellent idea ... not allowing your lifestyle to inflate is key to keeping even more of your money.