The first full month of my new zero-based budget was a success. My new budget plan is to set aside the amount of money I plan to spend at the beginning of the month in my checking account and any deposits are sent to my money market account. Once the money in my checking account is gone, I can’t spend any more money for the month.

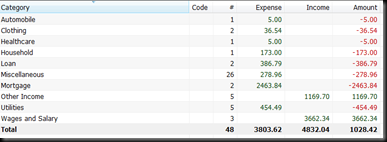

Income:

My income was a little bit higher this month due to getting my company bonus. The majority of the bonus was deposited into my rental property savings account to cover some upcoming maintenance items that need to be completed.

Expenses:

Nothing really out of the ordinary this month. I budgeted $4100 to spend for the month and I spent a little over $3800. The difference of $296.38 was transferred over to my money market account to zero out my checking account. On February 1, I’ll transfer another $4100.00 to my checking account and start all over again. (Note: The mortgage amount includes the mortgage for my primary home and my rental property).

I really like this new method and I think I’ll stick with it. Instead of trying to allocate money to several categories, you allocate money for the month. To me, it makes budgeting easier.

Nice. I hadn't ever really thought about it, but I've been inadvertently using the same method for years. It's gotten to the point where it actually bothers me if there is money sitting in my checking account. I want it off either paying for something or being invested!

Guy,

Don't you eat food? Where's that in your budget?

A zero based budget is a great way to discipline yourself and it really lets you see how much you spend on things in each category.

I have been using a ZBB for a while now and I love it...although I do have some wiggle room in a miscellaneous category every month.

@Jason: Food is actually is in the Miscellaneous category. Thanks for reminding me I need to seperate it out.

SGM, I really like your method as it reminds me of mine. I only allow spending in my checking account and at the end of the month, whatever is leftover gets transfered to my savings account. I transfer the money in WHOLE numbers. =)

And it's easier to budget when you're a SINGLE GUY. ;) It's harder budgeting when it's dual income with dual decisions with dual choices, etc, etc, etc...

I tried this general approach a while ago, and I always found ways to cheat. (Not clever ways, mind you...I just paid for things with my credit card when my cash was gone.)

It's an excellent tactic, though. Hope you have better luck with it than I did...and by "luck" I mean "some tiny amount of self-control when it comes to spending."

I wish it could've worked out better for me...much simpler than the complicated budget I'm presently using.